Natural Gas Supply

Natural Gas Price Management

We offer custom natural gas supply management solutions that help you control costs.

Gas Rate Plans That Suit Your Needs

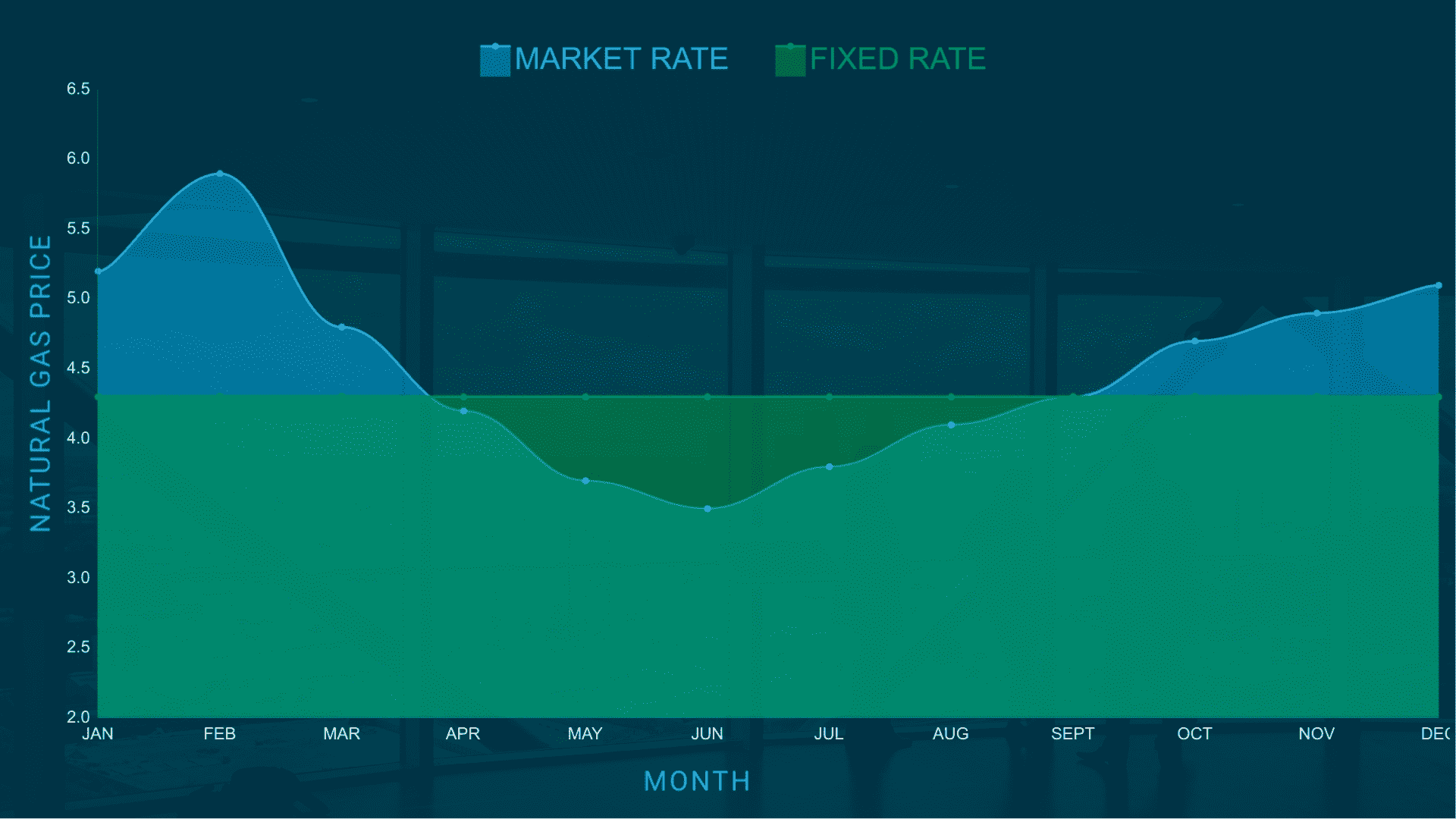

Fixed Rates

A fixed-rate natural gas product presents a vital option for businesses looking for stability in their energy expenditures. In deregulated natural gas markets, where prices can fluctuate due to changes in demand, supply, and various economic factors, choosing a fixed rate guarantees consistent natural gas costs throughout the duration of the contract. Such predictability is particularly advantageous for businesses, as it facilitates more precise budgeting, strategic planning, and financial forecasting.

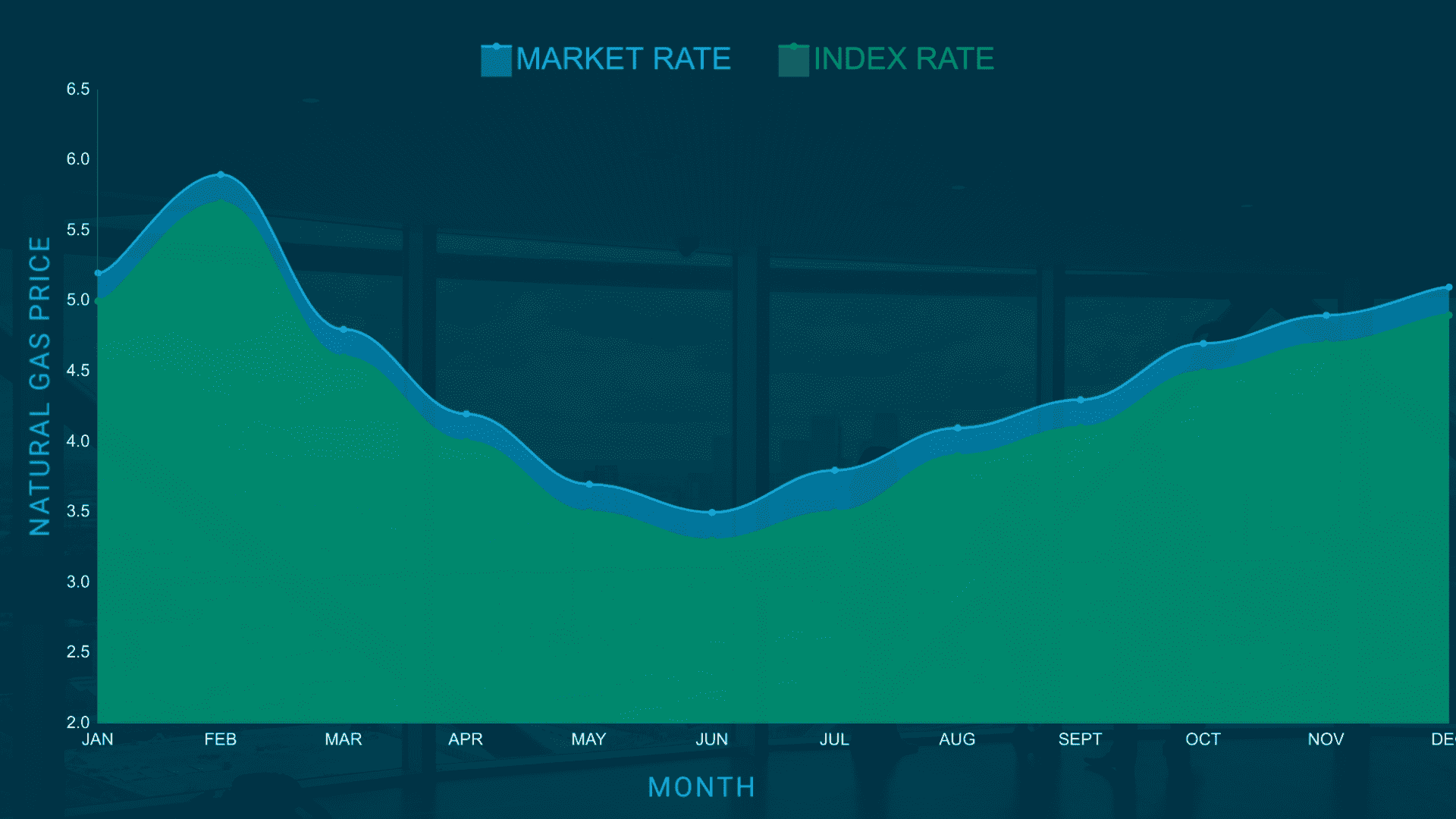

Index Rates

An index-based natural gas rate can be highly beneficial, especially in bear markets where NYMEX gas prices are generally lower. In contrast to fixed rates, an index rate flexibly changes in line with current market prices. In deregulated natural gas markets, this implies that users on index rates might gain from reductions in prices, opening up possibilities for cost savings when the market conditions are advantageous. Deciding between an index and a fixed rate ultimately hinges on individual risk tolerance.

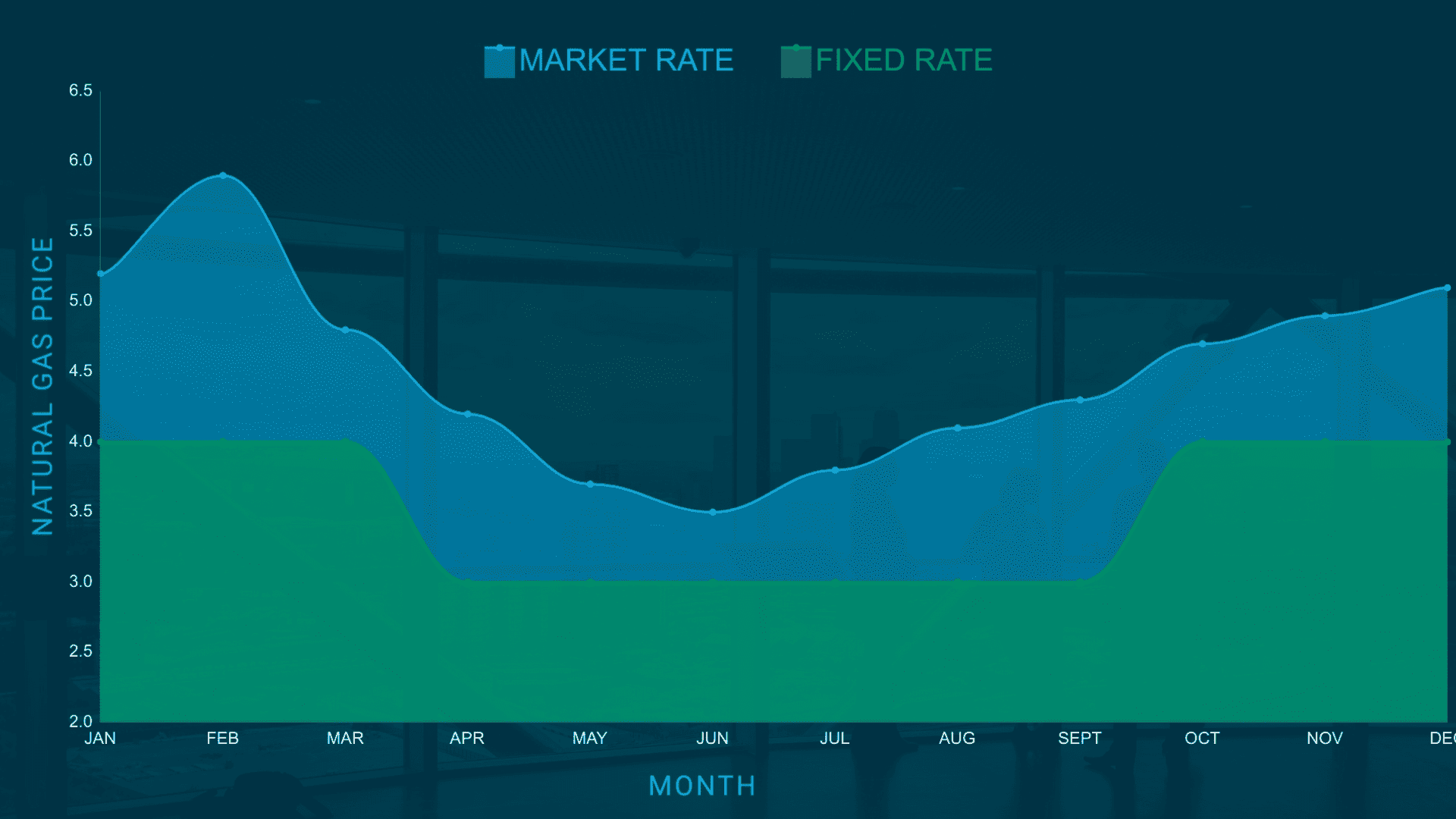

Fixed + Index Rates

Fixed + index natural gas rate plans provide a blended strategy in deregulated energy markets, offering a balance between price predictability and responsiveness to market fluctuations. Adopting this approach allows consumers to secure “fixed hedges,” locking in certain amounts of natural gas at pre-established rates, thereby guaranteeing price consistency for a segment of their gas usage. Concurrently, the index portion of the plan enables them to capitalize on bearish market situations, opening the possibility of cost reductions when market prices dip.

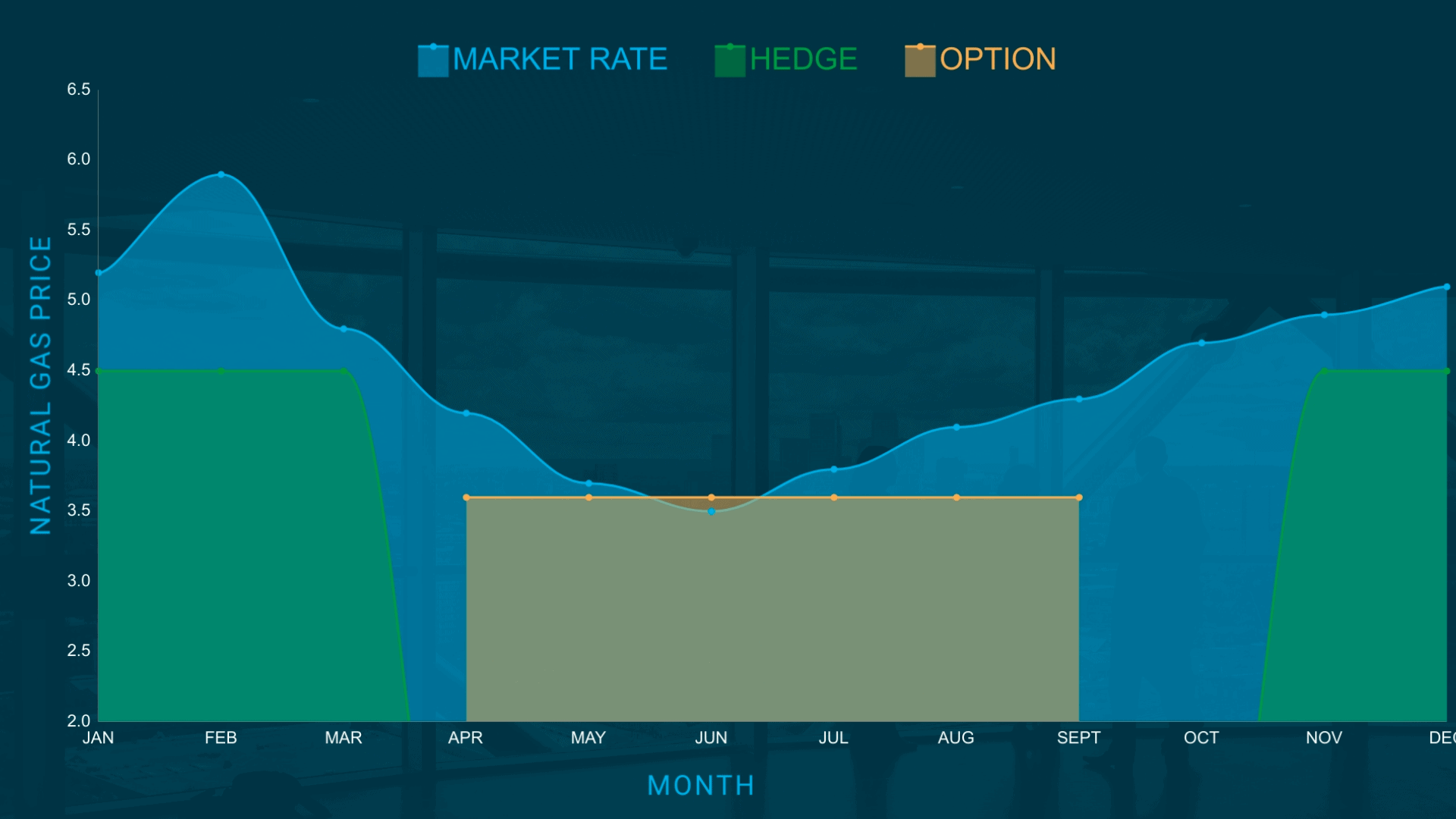

Custom Hedging

Commercial entities can effectively manage their natural gas costs by employing financial products like options, collars, and hedges. Options provide the flexibility to purchase gas at a future date and price, offering protection against price surges. Collars set a price range for buying or selling gas, limiting exposure to extreme market fluctuations. Hedges, on the other hand, allow businesses to lock in prices, providing cost certainty and aiding in budget stability. These financial instruments are crucial in mitigating risks associated with volatile natural gas markets.

From The Wellhead To Your Business

Gas Production

Gas Transport

Local Utility Companies

Retail Gas Suppliers

Diversegy

Your Business

What We Do

As a comprehensive natural gas brokerage firm, we’re here to assist if your business operates in a deregulated state. We hold licenses in all deregulated states, providing end-to-end brokerage services. Should you need a centralized solution for all your electricity supply requirements, Diversegy is your go-to destination. We offer services ranging from rate analysis to continuous bill oversight, simplifying the complexities of power price management for you.

Rate Analysis

We evaluate your exiting natural gas rates to determine if there is an opportunity to save money on your bill.

Supplier Vetting

We send out RFPs on your behalf to the nation's leading natural gas suppliers and vet price quotes.

Negotiation

Our team utilizes our decades of energy experience to negotiate favorable contract terms that you desire.

Management

Our customers enter into our ongoing market and rate monitoring programs to ensure future savings.

We are trusted by some of the nation’s leading brands:

Our Simple Process For Natural Gas Savings

Getting Started

Supplier RFP

Rate Analysis

Contract Negotiation

The Switching Process

Confirmation & Ongoing Monitoring

Ready To Learn More?

Our team of energy industry professionals has over 100 years of combined retail and wholesale market experience. Contact us today to learn more about developing an energy strategy for your business.

Gas Supply Product Details

Every business has different needs and uses for natural gas. Understanding the variety of natural gas supply options and tailoring them to your usage habits can lead to significant cost savings. Our area of specialization is in natural gas supply solutions. Below are some of the natural gas options we offer to our clients.

Fixed-Rate Natural Gas Plans

Great for those looking for long-term certainty.

Fixed-rate natural gas plans are highly favored among commercial clients in deregulated states. Natural gas suppliers provide these fixed rates as a straightforward method for customers to select their natural gas supply. Unlike variable rates that fluctuate with market changes, these rates remain constant throughout the term of your natural gas supply agreement. Key advantages of opting for a fixed rate for your business include:

- Fixed price per CCF for all gas usage

- Lock-in electric rates for up to 5 years

- Great for budget planning, and financial certainty

Index-Based Gas Plans

A good option for those looking to ride the market.

These types of natural gas plans are particularly attractive to businesses that have the capacity to reflect natural gas costs in their product pricing. Various processing plants and manufacturing firms producing commodity-like goods may find an advantage in a market-based natural gas plan. For instance, a steel plant cannot afford to be confined to a high fixed natural gas rate when the market price, such as those indexed to the NYMEX market, declines, as their production costs for steel are directly influenced by natural gas rates. These products offer numerous benefits in such scenarios.

- Enjoy downturns in the market

- Great when energy market prices are stable

- Good for businesses that treat utility costs as COGS

Fixed + Index Gas Plans

A combination of fixed and NYMEX natural gas rates.

Frequently used by significant natural gas consumers, a hedge + index arrangement allows you to pre-purchase specific quantities of natural gas usage in the futures market (“hedges”) while permitting the remainder of your consumption to align with the varying index market (“index”). This natural gas plan is generally adopted by our largest clients as it enables them to mitigate risk during potentially unstable NYMEX market periods and benefit from low, open market prices during times of reduced volatility. Some of its other advantages include:

- Fix gas prices during certain times or seasons

- Float the NYMEX during less-volatile periods

- Enjoy wholesale NYMEX rates for index volumes

Custom Gas Products

A sophisticated alternative for the largest consumers of natural gas.

Commercial organizations can strategically control their natural gas expenses by utilizing financial instruments such as options, collars, and hedges.

Options grant businesses the choice to secure natural gas at a predetermined price on a specified future date, serving as a safeguard against unexpected price increases.

Collars establish a defined price corridor within which natural gas can be purchased or sold, effectively reducing the risk of substantial market price swings.

Hedges, in contrast, enable companies to fix natural gas prices for a set duration, ensuring predictable costs and contributing to consistent budget planning. These financial tools play a pivotal role in minimizing the risks tied to the often unpredictable fluctuations in natural gas markets.

Get In Touch With Us Today.

Office

- 520 Broad Street, Newark, NJ 07102

Phone

- (201) 374-9641